The Illusion of Endless Prosperity: Unraveling the Crash of 1929 and its Prolonged Aftermath

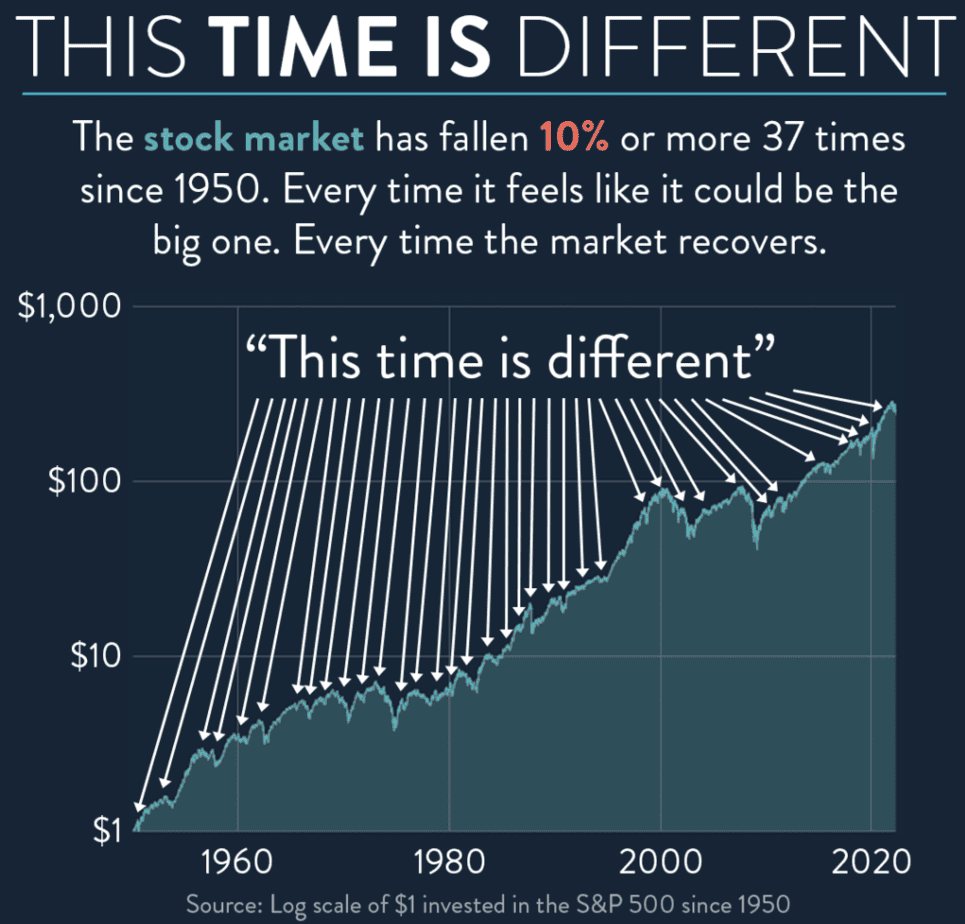

In the annals of financial history, there exists a cautionary tale that serves as a stark reminder of the perils of overconfidence and unwavering optimism. As Sir John Templeton aptly quipped, “The four most expensive words in the English language are ‘this time it’s different.'” Nowhere was this sentiment more evident than in the years leading up to the infamous Crash of 1929 and the subsequent economic turmoil that would shape an entire era.

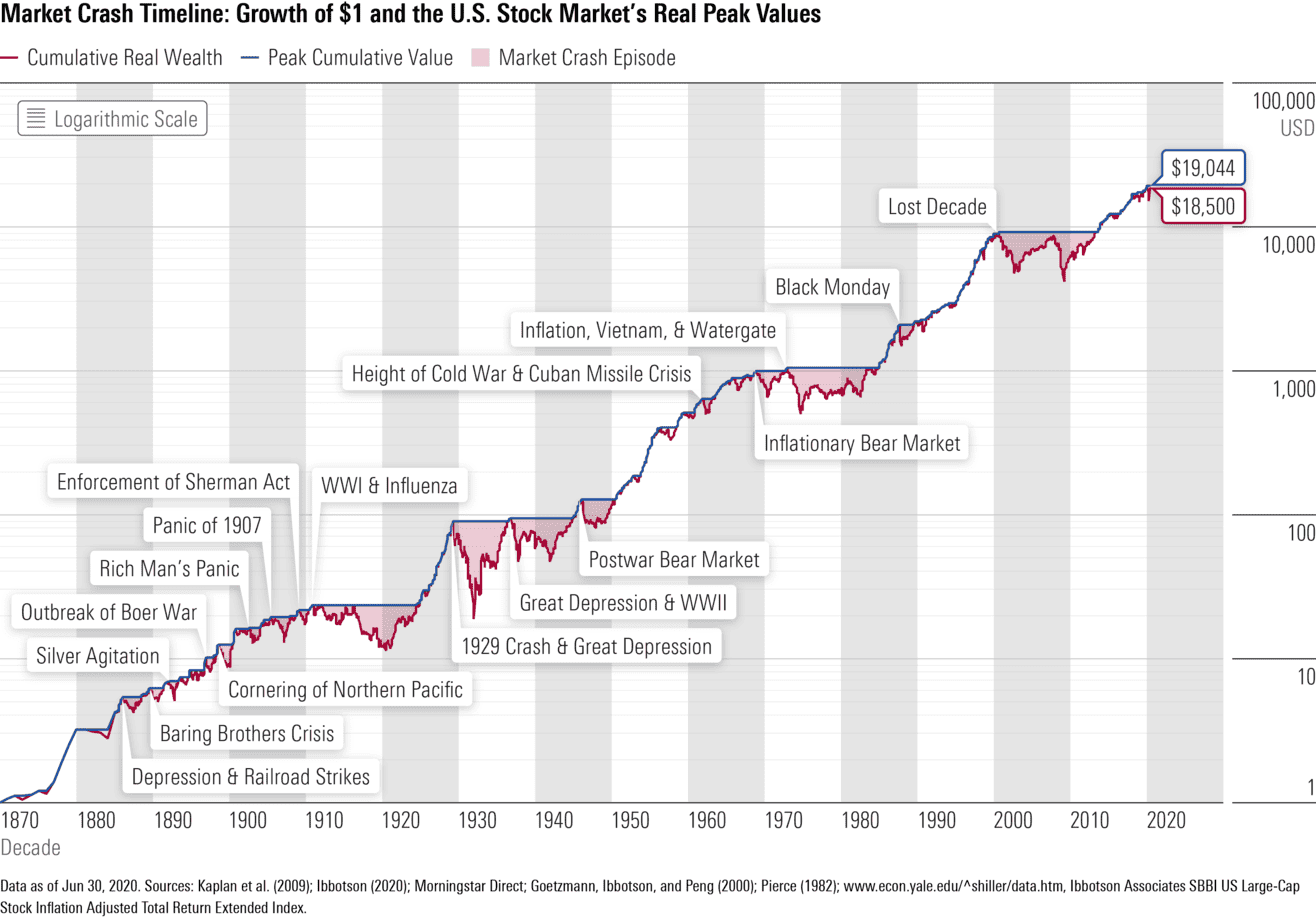

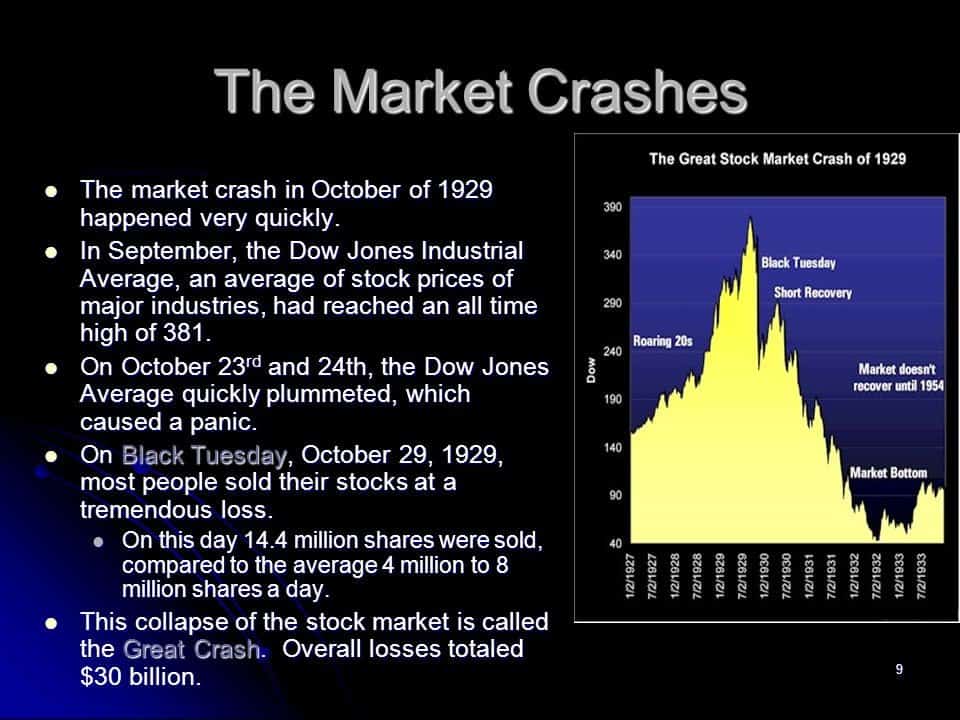

In the autumn of 1929, the renowned Yale economist Irving Fisher boldly proclaimed, “Stock prices have reached what looks like a permanently high plateau.” Little did he know that these words would soon be overshadowed by the deafening crash of the stock market, which, within weeks, witnessed a precipitous decline of more than a third. The worst was yet to unfold, as July 8, 1932, marked the day when the Dow Jones Industrial Average closed at a dismal 41.88, a staggering plunge of nearly 90 percent from its zenith in 1929. The stock market’s trajectory resembled not a plateau, but a harrowing precipice. The question that lingers is: why did Professor Fisher, a luminary of his time, misjudge the future so gravely? The answer lies in his unwavering belief in a seductive thesis that underpinned the great bull market of the late 1920s—a belief that America had embarked upon an era of boundless prosperity.

Yet, the notion of a new age of capitalism was not unique to this era. Throughout history, speculative periods had been marked by similar sentiments. In 1825, Disraeli asserted that prosperity would endure, distinguished by superior commercial knowledge. Walter Bagehot, a nineteenth-century journalist, observed that during speculative revivals, merchants and bankers deluded themselves into believing that the prosperity they witnessed was the dawn of an everlasting era.

However, it was the “new era” argument of the 1920s that held a particularly firm grip on the collective imagination. The proponents of this doctrine attributed the enduring “Coolidge prosperity” to several factors, including the extension of free trade, the curbing of inflation, and a scientific approach to corporate management, epitomized by the Harvard School of Business Administration and the innovative Fordism in Detroit. The belief in the Federal Reserve’s omnipotence further fueled the optimism. The Federal Reserve, established in 1913, was hailed as the remedy to economic cycles, as it could control interest rates and manipulate the money supply, ostensibly eradicating the recurring crises of the past.

Yet, this overconfidence led to reckless behavior in both banking and speculation, ultimately exacerbating the severity of the impending crisis. Fisher and others also attributed the enduring prosperity to the relaxation of antitrust laws, the promise of greater economies of scale through mergers, and significant gains in productivity, driven by investments in research and development.

Fisher’s optimism extended to the effects of prohibition, which began in 1920. He believed that a “dry” nation would boost worker efficiency and shift consumer demand from liquor to various industries, from automobiles to entertainment.

Fisher was not alone in his conviction. Influential figures such as John Moody, founder of a credit rating agency, and Bernard Baruch, a Wall Street financier, echoed the sentiment that America was entering a “new era” of unparalleled prosperity. Even President Herbert Hoover, in his 1928 nomination acceptance speech, proclaimed the end of poverty to be within sight, encapsulating the prevailing optimism of the time.

However, as history would painfully demonstrate, these optimistic beliefs were built on fragile foundations. The crash of 1929 would shatter the illusion of limitless prosperity, plunging the nation into a long and arduous period of economic hardship, known as the Great Depression. It was a stark reminder that in the world of finance, the most dangerous assumption is that “this time it’s different.”

In the heady days of the 1920s, a palpable sense of optimism permeated the American financial landscape. The prevailing belief was that the country had entered an era where economic fundamentals had undergone a profound transformation, rendering old notions of market volatility and cyclical fluctuations obsolete. If corporate earnings were now stable and on an upward trajectory, then it logically followed that their value should reflect this newfound stability. This optimism culminated in a remarkable stock market boom and the publication of Edgar Lawrence Smith’s groundbreaking book in 1924, “Common Stocks as Long Term Investments.”

Smith’s work sought to challenge the conventional wisdom that stocks were primarily vehicles for speculation. He argued that historical data, dating back to the mid-19th century, demonstrated that stocks consistently outperformed bonds, especially during the inflationary period of the early 20th century. Even when purchased at market peaks, Smith contended that stocks had a high likelihood of eventually recovering the initial investment. In statistical terms, he found that there was only a 1 percent chance of a stock market investor suffering a loss of principal over a fifteen-year period.

Smith’s case for stocks was further strengthened by the concept of compound growth derived from retained earnings, which were earnings not paid out as dividends. Kenneth van Sturm added to this argument by highlighting that bonds, unlike stocks, lost purchasing power during inflationary periods. Smith and van Sturm’s writings initiated a significant shift in the public’s perception of stock market investments and laid the foundation for what would soon be known as the “cult of the common stock.”

The traditional yardsticks for valuing stocks, which relied on pricing stocks at roughly ten times earnings and expecting dividend yields to surpass bond yields, were supplanted by a new method—discounting future earnings. This approach involved reducing future earnings to their present value by applying a discount rate. However, this method was highly speculative, as it relied on uncertain estimates of future earnings. As economist John Maynard Keynes cautioned, the basis for such estimates was often precarious, making stock valuation a speculative endeavor.

Despite these warnings, the stock market embraced the new valuation methodology, leading to a speculative frenzy. Investors were willing to pay a premium for stocks based on projected future earnings, effectively “discounting not only the future, but the hereafter,” as one observer noted.

Critics, however, were not blind to the dangers of this new era of stock valuation. Lewis H. Haney, writing in the North American Review, argued that forsaking a fair current return for the allure of future gains was pure speculation, not investment. He cautioned that it placed faith in the uncertain future at the expense of present safety. Alan Temple echoed these concerns, stating that buying stocks at prices already steeped in future expectations might invalidate the theory of common stock investment.

Despite these reservations, several factors fueled the bullish sentiment in the late 1920s. President Calvin Coolidge, known for his laissez-faire economic philosophy, favored minimal government intervention and celebrated business as the lifeblood of America. His Treasury Secretary, Andrew Mellon, implemented policies that lowered income and corporate taxes, leading to increased investment in stocks and higher after-tax earnings.

However, the prosperity of the 1920s did not extend to workers, as unions were weak, and real wages declined while corporate profits surged. To maintain demand, consumer credit expanded rapidly, allowing Americans to purchase items like radios, fridges, cars, and clothing on credit. This speculative element in the growth of consumer credit was akin to consuming future earnings for immediate gratification, a practice that would prove costly in the end.

Margin loans, which allowed investors to borrow money against their stock holdings, were another source of speculative credit. As the stock market climbed, investors increasingly used margin loans to magnify their gains. By October 1929, margin loans reached nearly $16 billion, equivalent to 18 percent of the total stock market capitalization. This practice had long been considered a source of instability in the financial system, but it continued unchecked as long as the market kept rising.

The Federal Reserve, tasked with maintaining financial stability, initially contributed to the stock market boom by lowering interest rates in 1925. However, as speculation grew, the Fed raised interest rates in a bid to curb excessive lending. These efforts proved futile, as speculators were undeterred by higher rates, driven by the allure of stock market profits.

Additionally, American corporations and foreign banks, less responsive to the Federal Reserve, increasingly supplied margin loans. Companies raised funds by issuing stocks and then lent surplus cash in the call loan market at high interest rates, further inflating stock prices. This self-reinforcing cycle of speculation became increasingly precarious.

Brokerage houses played a pivotal role in this speculative fervor, with branch offices multiplying by over 80 percent in 1928 and 1929. Aggressive sales tactics, quotas, and cross-selling became the norm. Charles Mitchell, president of the National City Bank, pioneered these practices, earning the nickname “Mitchellism” for aggressively peddling second-rate securities to the public. He became the embodiment of stock market optimism, assuring investors that stocks were as safe as bonds and dismissing concerns about the market’s health.

As the United States emerged as the world’s leading creditor nation after World War I, speculative lending to foreign countries surged. The National City Company, a subsidiary of the National City Bank, became a prominent distributor of high-yield bonds from South American and Central European nations. Despite concerns about the quality of these bonds, their sale to American investors continued.

The culmination of these factors was a stock market that had spiraled into a speculative frenzy by the late 1920s. The Crash of 1929 would ultimately expose the fragility of this optimism, shattering the dreams of countless investors and ushering in an era of economic hardship—the Great Depression. Charles Mitchell, who had fervently championed the bull market, would also suffer staggering personal losses in a futile attempt to support his bank’s share price.

The Roaring Twenties, a time of exuberance and excess, serves as a cautionary tale for generations to come. It underscores the importance of prudence, skepticism, and a clear-eyed assessment of economic realities in navigating the complex world of finance—a lesson that resonates even in today’s financial landscape.

In the dynamic landscape of the 1920s, the stock market was overwhelmingly dominated by the wealthiest echelons of society, where a mere one-tenth of the population controlled a staggering nine-tenths of the nation’s wealth. Within this privileged realm of speculators, two distinct groups emerged as prominent players, leaving an indelible mark on the era’s financial landscape.

The first group was comprised of astute businessmen who had initially amassed their fortunes in the burgeoning automobile industry and later turned their attention to the stock market as a form of entertainment and wealth enhancement. This group, known colloquially as the “Detroit crowd,” boasted luminaries such as Walter Chrysler, the renowned car manufacturer, the Fisher brothers, whose family enterprise specialized in car body production, and John J. Raskob, a prominent director at General Motors. However, the most flamboyant figure in this group was William Crapo Durant, the visionary founder of General Motors. Having resigned from the company in 1920 after a substantial loss incurred through stock speculation, Durant redirected his professional focus to grand-scale stock operations. By 1929, Durant’s investment pool was rumored to control assets exceeding $4 billion in value, equivalent to approximately $38 billion in today’s currency. His speculative endeavors, although eccentricities marked his private life, remained steadfastly bullish.

A second influential clique of speculators was composed of Irish-Americans, including notable figures such as Charles Mitchell, hailing from the immigrant-rich Boston suburb of Chelsea, Mike Meehan, another Bostonian who transitioned from a Broadway ticket tout to a broker, and Joseph P. Kennedy, the father of a future President, who famously exited the market before its dramatic fall. These men, born into modest circumstances and excluded from the East Coast’s financial elite, were driven to take significant risks to carve out their positions. Their outsider status aligned with the adage of the eighteenth-century financial writer Thomas Mortimer: “He who values not his neck, because he is conscious it is worth nothing, may take the boldest leap.”

Contrary to the nineteenth century, when concerns about market manipulation deterred the public, the stock market activities of these major players in the 1920s had an inviting effect on outsiders eager to partake in the fortunes of figures like Durant. Rumors of pool operators taking control of a stock were met with eager anticipation. Exploiting the public’s susceptibility, one pool operator even resorted to bribing journalists to disseminate favorable stories. For instance, Mike Meehan’s initial pool in Radio Corporation of America (RCA) shares, which propelled RCA’s stock price from 95½ to 160 in a mere ten days in March 1928, was credited with rekindling bullish sentiment in the market. Mitchell’s National City Company left little to chance; it joined a pool in Anaconda Copper late in 1928, selling inflated shares to its own clients. In just two months, the company unloaded over a million Anaconda shares to the public, reaping a profit of more than $20 million at a time when copper prices had actually plummeted by over 25 percent.

Significantly, corporate directors themselves often participated in these stock pools. Both the chairman and president of Anaconda, along with Percy Rockefeller and James Stillman, directors at the National City Bank, were involved in the pool for their own company’s stock. Walter Chrysler orchestrated a pool in his eponymous company’s stock, while Mrs. David Sarnoff, the wife of Radio Corporation of America’s founder and chairman, was a member of Meehan’s Radio pool. In a noteworthy case, Harry T. Sinclair, the oil magnate previously implicated in the Teapot Dome scandal, enlisted speculator Arthur Cutten, along with Chase Securities Corporation and Blair & Company, to manipulate Sinclair Consolidated Oil Corporation’s stock price successfully, yielding the syndicate a $12 million profit. Remarkably, both the presidents of Blair & Company and Chase National Bank also served as directors of Sinclair Oil. It was estimated that in 1929, the stocks of over a hundred companies listed on the New York Stock Exchange were subject to similar pool manipulations.

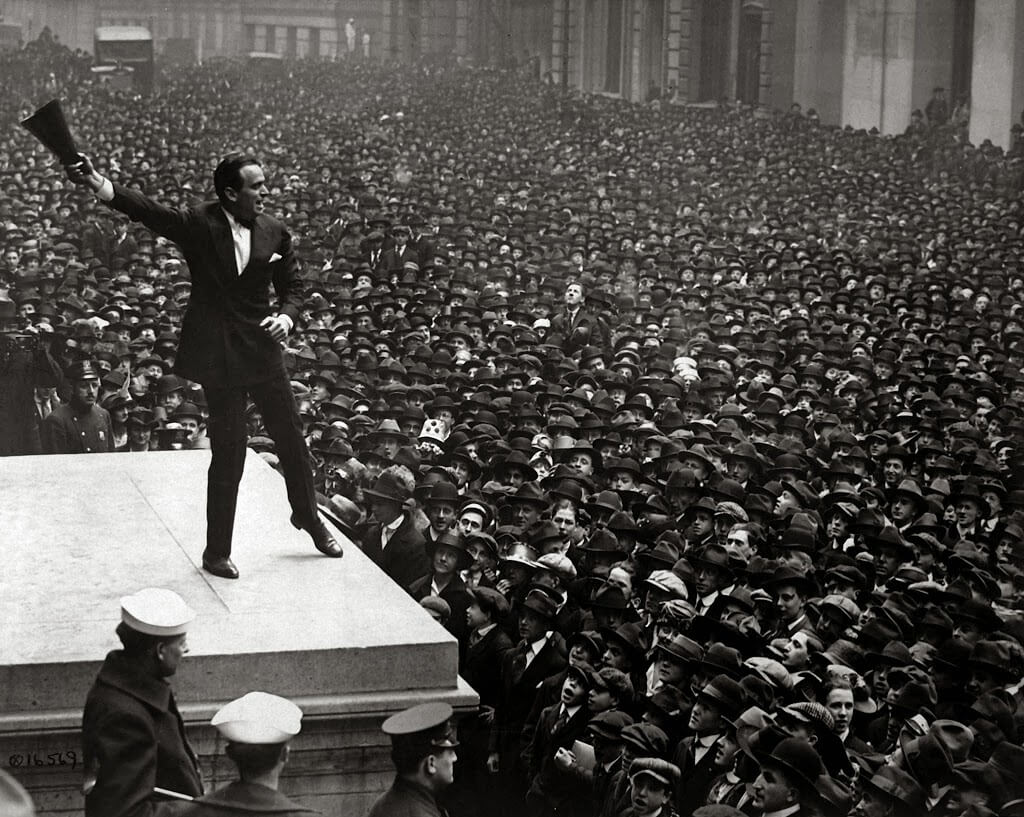

Despite the total number of stock market participants in the late 1920s being estimated at one to two million, a fraction of the nation’s population exceeding 120 million, the bull market captivated public interest far beyond these figures. As economist J. K. Galbraith astutely observed, it wasn’t just the scale of participation that was remarkable but the way in which the stock market became a central fixture of the culture itself. The allure of the stock market even extended to leading celebrities and entertainers of the time, including luminaries like Groucho Marx, Irving Berlin, and Eddie Cantor, all of whom ventured into margin trading, only to ultimately suffer substantial financial losses. In contrast, Charlie Chaplin, by wisely divesting from stocks in 1928, managed to escape the market’s subsequent turmoil with his wealth intact.

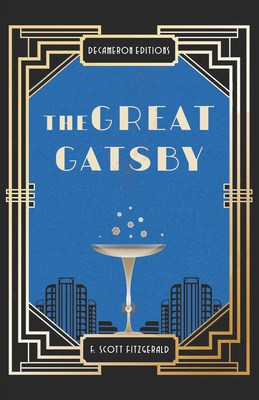

During the Roaring Twenties, the stock market became akin to a secular religion, embodying the era’s qualities of extravagance, cynicism, and materialism. F. Scott Fitzgerald’s timeless work, “The Great Gatsby,” published in 1925, exemplifies this spirit. The novel’s protagonist, Jay Gatsby, represents the quintessential self-made man, driven by materialistic ambitions. Gatsby’s tragic tale, rooted in the pursuit of wealth and social status, mirrors the broader themes of the era. His lavish parties and decadent lifestyle are evocative of Trimalchio’s feast in Petronius’ “Satyricon,” revealing the parallels between the excesses of ancient Rome and the opulence of Long Island and Wall Street. For Gatsby, who epitomizes the ephemeral nature of human ambition, the price of clinging to a single dream for too long is ultimately death—a fate that would also befall many of the nation’s speculators.

The fascination of speculators with emerging technologies found ample opportunities in the thriving bull market of the 1920s. The automobile industry, a symbol of economic progress and a popular subject of speculation, replaced railroads as the driving force behind prosperity. This shift not only reshaped the nation’s culture but also transformed its landscape. New roads, highways, and garages sprang up to accommodate the growing number of passenger cars, which skyrocketed from seven million to twenty-three million during the decade. The introduction of the new Model A at Ford’s New York headquarters drew over a million eager visitors, reflecting the excitement that permeated the stock market.

General Motors, in particular, became emblematic of this era, with its stock price surging over tenfold between 1925 and 1928. This remarkable ascent was so rapid that it thrust the stock market into the headlines of newspapers across the nation. J. J. Raskob, in his proposal for universal wealth in August 1929, highlighted that a $10,000 investment made a decade earlier in General Motors would have grown to more than $1.5 million.*

However, the fervor surrounding the motorcar was eclipsed by the enthusiasm for the radio, introduced by Westinghouse in 1920. The radio industry quickly became a cultural phenomenon, shaping fashion trends and disseminating information across the country. Radio set sales soared from $60 million in 1922 to a staggering $843 million just six years later. Radio Corporation of America (often referred to as “Radio”), the industry leader in both manufacturing and broadcasting, experienced a meteoric rise in earnings, growing from $2.5 million in 1925 to nearly $20 million in 1928. Its stock price mirrored this ascent, climbing from a low of VA in 1921 to $5A by early 1928. With the help of Mike Meehan’s pool operations, RCA’s stock reached a peak of 114 in 1929, an astounding seventy-three times its earnings and nearly seventeen times its book value. RCA, despite its high leverage, absence of dividends, and rapid expansion through acquisitions, became the most heavily traded stock on the New York Stock Exchange, earning the moniker “General Motors of the Air.”

The excitement surrounding Charles Lindbergh’s solo transatlantic flight in 1927 added further momentum to the aircraft industry’s appeal to speculators. Companies like Wright Aeronautical, Curtiss, and Boeing Airplane (later renamed United Aircraft and Transport in 1929) gained favor in the stock market. Additionally, as Hollywood transitioned from silent films to talkies, major studios were consolidating their positions and experiencing rapid profit growth. Joseph Kennedy’s merger of his movie interests into RKO in October 1928 and Fox Film Corporation’s acquisition of Loews chain of movie theaters for $72 million the following year exemplified the industry’s transformation. However, despite public perception, movie stocks would perform poorly during the ensuing Depression.

The dominant characteristic of the 1920s stock market was not just the pursuit of speculative innovations but the pervasive use of debt to amplify investments and magnify gains. Margin loans allowed speculators to venture into the market with greater ease, leading some to quip that during the bull market, one could select stocks blindly and still see them rise in value. This leveraged approach extended beyond individual margin holdings; it became ingrained in the financial structure of corporate America. Utility and railway companies were amalgamated into sprawling holding companies, known as “systems,” constructed upon layers of debt. Samuel Insull, a former aide to Thomas Edison, established a vast utility network in the Midwest that diversified into tire manufacturing, shoe factories, and real estate. His Insull Utility Investments, an investment trust, held cross-shareholdings in multiple utility companies, each heavily leveraged with debt. Consequently, even a slight increase in the earnings of the operating businesses had a disproportionately significant impact on the profitability of the holding company.*

Moreover, profits were artificially manufactured through subsidiaries selling assets to each other at inflated prices. The intricate web of cross-shareholdings among heavily indebted companies further amplified the effects of corporate leverage, resembling the speculator’s use of margin loans to magnify investments.

*Corporate leverage operates in a similar manner to the speculator’s margin loan. For example, if a company has earnings before interest of $100 million and interest payments of $90 million, then its net profits before tax are $10 million. A 10 percent increase in earnings to $110 million will produce a 100 percent rise in pre-tax profits to $20 million. Insull and other holding company operators in the 1920s enhanced the effects of corporate leverage by creating a pyramid of cross-shareholdings between heavily indebted companies.

Insull’s business empire, with its intricate web of holdings and investments, presented a puzzle too complex for even the most sophisticated investors to decipher. To navigate this complexity, Insull devised a unique strategy: selling his companies’ shares directly to their customers. This unconventional approach marked a significant shift in the financial landscape.

As the bull market of the 1920s reached its zenith, a frenzy for utility holding companies gripped the nation. These companies, which controlled a substantial portion of the country’s electricity production, saw their shares soar to dizzying heights, reaching over four times their book value. Dividend yields dwindled to less than 1 percent, underscoring the speculative fervor that had engulfed the market.

In January 1929, the esteemed investment bank J. P. Morgan played a pivotal role in promoting the United Corporation, a major player in the electric utility sector. However, it later came to light that Morgan had retained nearly two million warrants, granting the right to subscribe to new shares in the company at a fixed price. These shares were distributed to Morgan’s “preferred” clients, a list that included influential figures such as Charles Mitchell of the National City Bank, J. J. Raskob of General Motors, and former President Calvin Coolidge.*

The craze for holding companies extended well beyond the utilities sector. The van Sweringen brothers, property developers from Cleveland, Ohio, employed a convoluted structure of holding companies to consolidate several Midwestern railroads. Their Alleghany Corporation, laden with debt, also garnered support from J. P. Morgan. Meanwhile, Ivar Kreuger, known as the “Match King,” built a global monopoly controlling approximately three-quarters of the world’s match production. His heavily-indebted holding company, Kreuger & Toll, sought financing through bond issuances in New York.

Banks also gravitated toward this trend. The Transamerica Corporation, for instance, merged the banking interests of A. P. Giannini, including the California-based Bank of Italy and the Bank of America in New York. In Detroit, two powerful holding companies, the Guardian Detroit Union Group and the Detroit Bankers Company, held a virtual monopoly over local banking.

However, the concept of holding companies found its widest application in the realm of investment trusts. These trusts, which had their origins in Scotland in the late nineteenth century, aimed to provide small private investors with the benefits of professional management and diversification at a low cost. They thrived during the bull market, with over two hundred new investment trusts launched in 1928, boasting combined assets exceeding a billion dollars. This was a stark contrast to just three years earlier when the total capital of American investment trusts amounted to less than half a million dollars. During the first nine months of 1929, a new investment trust emerged almost daily, collectively issuing over two and a half billion dollars’ worth of securities to the public.

Investment trusts were marketed to the public with all the exuberance of the new era. Professor Irving Fisher, in an article from the summer of 1929, touted their role in stabilizing the market, suggesting that they curbed speculative fluctuations. Fisher argued that investment trusts made rational decisions based on real expectations of market movements, thereby ensuring that stocks traded closer to their true value. The high turnover of shares within investment trust portfolios was celebrated as sound management, and it was even suggested that their purchases bestowed a newfound “scarcity value” upon stocks.

In reality, the impact of investment trusts on the stock market was far from stabilizing. Their managers heavily invested in blue-chip stocks and extended surplus cash to the call loan market, stoking demand for shares and fueling speculation. These trusts borrowed extensively against their assets to amplify profits, contributing to increased stock market volatility. The high turnover of stocks in their portfolios often reflected trend-following behavior rather than a sober pursuit of intrinsic value. Investment banks, the sponsors of these new trusts, frequently offloaded difficult-to-sell stocks into their portfolios, exposing investors to a diverse array of risky assets.

Moreover, some investment trusts invested in the shares of affiliated trusts, a practice that would later become problematic. The story of the Goldman Sachs Trading Corporation is illustrative. Launched in December 1928 with a capital of $100 million, the company initially “invested” $57 million in its own shares. In July 1929, it introduced the Shenandoah Corporation, in which it retained a substantial stake. Just a month later, another investment trust called Blue Ridge emerged from Shenandoah. These investment companies relied on leverage to enhance their returns, and the public initially embraced this practice of what Professor Galbraith referred to as “fiscal incest,” propelling shares in Goldman Sachs Trading to nearly three times their book value.

Not everyone, however, shared the prevailing optimism. In the summer of 1929, the chairman of the New York State Assembly’s Committee on Banks voiced concerns that if a market crash were to occur, “the investors who own investment trust shares would be worth little or nothing after the banks took up the stocks that are given as security for loans.” Prominent banker Paul M. Warburg, a key figure behind the Federal Reserve System’s establishment, dismissed investment trusts as “incorporated stock pools.” Warburg’s apprehensions extended beyond investment trusts. In March 1929, he warned readers of the Commercial and Financial Chronicle that unchecked speculation and excessive expansion of installment credit could jeopardize the nation’s long-term prosperity. When Herbert Hoover assumed the presidency early in 1929, he also attempted to address the issue of speculation by urging newspaper editors to caution their readers about stock prices. However, these admonitions proved futile, as the prevailing sentiment in favor of speculation remained unshaken.

The arguments against the soaring stock prices, which had pushed valuations to thirty times earnings, were indeed compelling. Corporate earnings had lagged significantly behind the rapid rise in share prices since 1924. High interest rates were beginning to stifle economic activity, while installment loans had reached their peak due to stagnant wage growth. Gold was flowing into New York from London and Berlin, driving up European interest rates and weakening European economies, which had negative implications for American exports. Additionally, declining prices for agricultural commodities were eroding the purchasing power of American farmers, who constituted a substantial portion of the population.

Nonetheless, these valid concerns paled in comparison to the allure of speculative profits. By 1929, share prices had risen at a pace three times faster than corporate earnings, but the prospect of immediate gains from stock speculation continued to captivate investors. Bernard Baruch, in his introduction to the 1932 edition of Mackay’s “Extraordinary Popular Delusions and the Madness of Crowds,” likened American speculators in 1929 to individuals caught up in crowd psychology. This psychology, as observed by German playwright Schiller, often led to otherwise rational individuals behaving irrationally when part of a crowd.

Early studies of crowd mentality conducted by Freud and the nineteenth-century psychologist Gustave Le Bon identified several characteristics commonly found in bull market mentalities. These traits included invincibility, irresponsibility, impetuosity, contagion, changeability, suggestibility, collective hallucination, and intellectual inferiority. The crowd, much like the stock market, thrived on uncertainty and rumor. It was drawn to leaders or shared tendencies that provided a focus of interest and purpose, akin to the forces that animated a bull market.

Furthermore, both the crowd and the stock market were inherently unstable, lacking a point of equilibrium. At moments of dispersal, panic often ensued, even over trivial catalysts. One notable aspect of crowd behavior was intellectual inferiority, which manifested as individuals selectively processing information to align with their existing beliefs—a phenomenon known as “cognitive dissonance.” Dissonant information, conflicting with the collective fantasy, was typically shunned. People either rejected such information or sought to persuade others to their viewpoint. Leon Festinger’s “Theory of Cognitive Dissonance” suggested that individuals would tolerate increasing levels of dissonance when motivated by enticing rewards. In the context of financial markets, this meant ignoring negative news in pursuit of immediate speculative gains.

This behavior was exemplified by speculators within William Fowler’s circle during the 1860s. Despite knowing they were wrong, they bolstered each other’s confidence through arguments in favor of further stock price increases. They were willing to overlook the incongruity between their beliefs and reality in their pursuit of profits.

In conclusion, the 1920s were characterized by a financial landscape marked by complexity, speculation, and a fervor for investment opportunities. Insull’s innovative approach to selling shares directly to customers exemplified the era’s unconventional strategies. Utility holding companies, investment trusts, and a wide range of financial entities captured the public’s imagination, with shares trading at dizzying valuations. However, beneath the surface of prosperity lay a precarious foundation, with economic warning signs and unsustainable practices that would ultimately lead to the devastating crash of 1929. The era’s collective psychology, reminiscent of crowd behavior, drove individuals to embrace speculative excesses while ignoring the impending risks.