Spot Major Market Moves

USE SPREADS TO SPOT MARKET MOVES

In today’s uncertain markets, traders who want to spot major market moves and protect themselves against large losses should consider using spread trading. Spreads are one of the most powerful market indicators. The two major ways looking at them are the price premium structure and the strengthening/weakening of the spread.

- Price Premium

It means that the nearby futures contract is trading at a higher price than the next month contract. This occurrences are rare since the normal price structures has the distant months selling at a higher price.

- Strengthening and Weakening of the Premium

Things that can create a premium are that the buying activity of the front month is so heavy that people are bidding the price higher. Thus the price of the front month becomes higher than the contracts traded in distant months. The important thing to observe is the point in time when the nearby contract trades at a higher value than the distant months. This gives us a bullish signal.

Markets can enter premium in two different ways:

- Premium comes on before a major price move.

- Premium comes on after the rally has started.

SPREAD TRADING

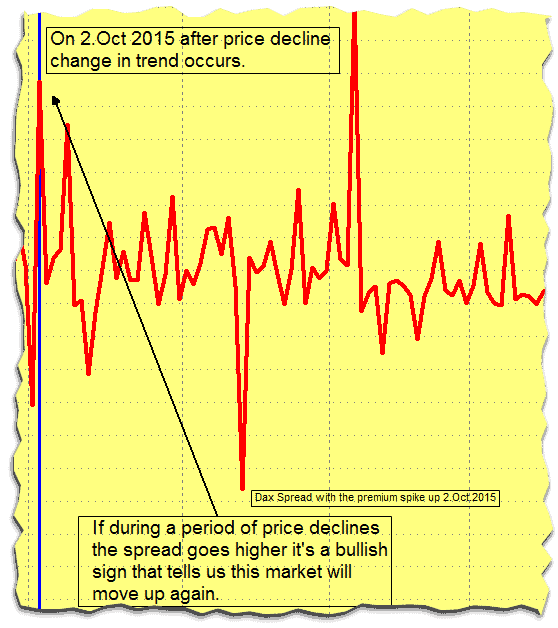

It’s important to see what the premium is doing in relationship to the market. If the prices are going higher we should have a high in the spread. If the opposite is true its a negative sign since the buyers are not bidding for the nearby anymore. In a market correction the premium should move more than the price action. Generally speaking it is a bullish sign. The premium is telling us that this is just a short-term correction

If during a period of price declines the spread goes higher it’s a bullish sign that tells us this market will move up again. If the prices are going up and the premium spread is lower ( distant months going higher in price, front month prices going lower or increasing at a lower pace) it gives us a bearish sign.

This price changes are giving us a lot of information about the commercials activity (the Commitments of Traders (COT) reports provide a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC). One must realize that the Commercials are trend enders. They are not showing a top or bottom in a given market but a major shift in market trend that’s coming. The key is to compare the actual readings to high/low levels in the last 12 months and compare it to the premium.

Another good idea is to combine seasonal analysis with the premium price structure which can give us high probability trades. Spread trading strategies use these kind of tools to define their entry and exit points. The construction of spreads can considerably lessen risk in trading. Every spread is a hedge. Trading the difference between two contracts in an intramarket spread results in much lower risk.