Brainstorming Ideas To Create Winning Crude Oil Trading Strategy

Crude Oil Trading Strategy – Imbalances

Today we gonna show you something really interesting and when done correctly it can be exploited. We are talking about imbalances. You can basically do this with any time frame and any contract especially those with rising volatility and severe directional price changes for a prolonged period of time.

First of all some short introduction to the mechanics of futures trading. Futures contracts involve two parties. One party thinks the price is going up and takes a long position. Another market participant thinks that the futures price will go down and he goes short. The daily future price for a commodity is the price which exactly balances the number of longs and shorts. When there is an imbalance of longs and shorts it changes daily futures prices. If many participants think the future price will increase then the price of the futures contract has to rise until there are equal numbers of longs and shorts. Therefore large price swings in futures prices result from large imbalances in the number of participants. Let’s be more precise here – large price swings in futures prices result from large imbalances mostly when the big boys enter or exit the trading arena. This means what ? Imagine you are a trader in the crude oil futures market and you are holding a large number of contracts. Can you unload the contracts and sell them all at once without distorting the price ? No, you can’t. So you terminate your positions step by step and hope that nobody finds out that there is some big trader unloading his positions.

As a trader you design, test, optimize, test, optimize, ……….. and finally/hopefully implement your profitable trading strategy. The way you develop your trading strategy will make it impossible to find these kind of trades, anomalies or market manipulations that are happening within a short time frame ( the patterns last only for several weeks rarely months). So sometimes it can be a real eye opener looking at the micro structure of a market and try to find something with a repeating occurrence in the market.

Remember the currency trading scandal ? A financial scandal that involves the revelation that banks cooperated for at least a decade to manipulate exchange rates. Market regulators in Asia, Switzerland, the United Kingdom, and the United States began to investigate the $5.3 trillion-a-day forex market scam. The currency dealers said they had been front running client orders and rigging the foreign exchange benchmark WM/Reuters rates and pushing through trades before and during the 60-second windows when the benchmark rates are set. The manipulation occurred daily in the spot foreign-exchange market.

Now let’s have a look at what we observed since the oil market started to rise again. Something is clearly going on at 5 am in the crude oil market. We did some tests to see what happens if we enter the crude oil market exactly at that time. We did not run a lot of optimization tests nor we improved our entry/exit techniques. This is just to show you what’s going on in the markets and to give you some ideas when doing your own research. You can find these kind of trades in almost every market. We do not claim that all markets are manipulated nor are we trying to explain why it’s occurring. It really doesn’t matter. What’s important is that it happens and that such imbalances can be exploited.

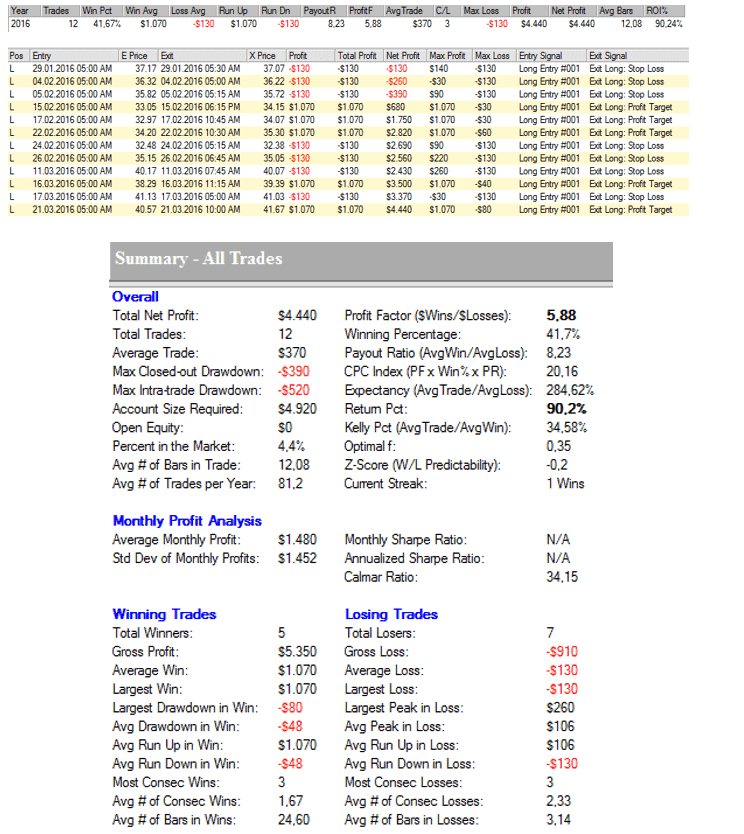

Here are the results from 29.01.2016 till 21.03.2016 :

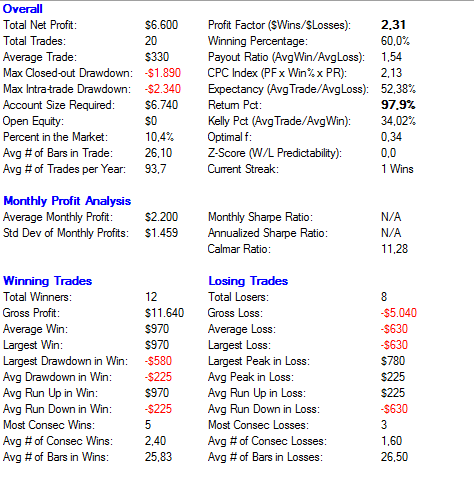

Changing the stop-loss will of course increase the winning % :