Risk Management

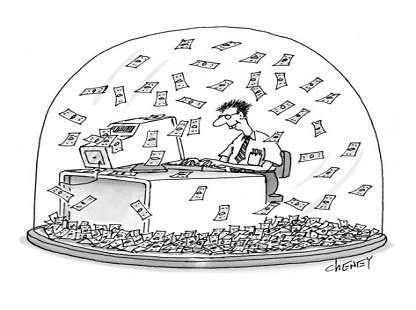

If one thing can be called the holy grail of trading or at least come close to it then its money management. Some people call it diversification while others call it how to wisely invest your hard-earned dollar.In simple words money management is the rule book that tells you how much of your money you should put at risk for a particular trade.

We ar writing this post to give you an overall understanding of money management and how to use it for your trading strategies. The material we cover is quite complex but we will split this topic into several posts so you can easily grasp the concept.

The Money Management Experiment

Ralph Vince is a famous and well-respected industry professional. He performed an experiment with 40 PhD students and ruled those out with a background in statistics. In the game each of them was given 10.000$ and 100 trials with a 60% chance of winning. The staggering result of this experiment was that only two students out of 40 managed to make any money. Most of the students lost all their money . Why? Poor money management. No matter how good your system might be in terms of winning % it can still turn into a losers game without the implementation of proper money management techniques. The reason why they lost is the gambler’s fallacy. After having several losing strikes and being sure the next bet is gonna be a winner they increased their bets and got caught off guard.

Lets have a look at this from a statistical perspective and see how much money you need to break even after a drawdown.

| Drawdown | Gain to Recovery |

|---|---|

| 10 | 11.11% |

| 15 | 17.6% |

| 20 | 25% |

| 25 | 33% |

| 30 | 42.85% |

| 40 | 66.66% |

| 50 | 100% |

| 60 | 150% |

| 70 | 233% |

| 80 | 400% |

| 90 | 900% |

Let’s start where the fun begins and have a look at the various money management models. You can apply the methods to almost any asset. A very important factor to keep in mind is that the thing that will make or break your trading system is the implementation of the proper risk management model. It’s the part of your system that tells you how much money at any given time should be invested.

Look at the professional black jack players where the odds of winning are heavily against them yet they still manage to make money. The only difference why they are on the winning side is proper money management. Gamblers use an anti-martingale bet sequence where they increase the risk when they win. The same method can be implemented by traders. It allows you to determine your reward and risk parameters. Many traders implement a fixed % as their stop-loss which clearly has nothing to do with intelligent risk management. Controlling risk by limiting the amount you lose is not money management.

Before implementing the models we determine the equity in your account by using the total equity model.

The Total Equity Model determines the amount of cash in your trading account. The amount is determined by the amount of cash in your trading account plus any open positions.

Risk Management Method – Units per Fixed Amount of Money

This method tells you to trade one unit for every X dollars in your trading account. The advantage of this method is that you never reject a trade because it is too risky or too volatile. This is the simplest of all position sizing methods.

Example:

We want to trade $100,000 worth of S&P500 futures per position. We divide the required initial margin amount of $5,000 into $100,000 thereby giving us 20 units to enter the position with. If the position rises and we have a gain in our account of lets say $20,000 it gives us a total of $120,000. We then divide $5,000 into $120,000 to provide us with an entry of 24 units.

This method gives you the ability to adjust position sizes immediately. You specify a percentage of available capital that each position should take. The benefit of this method is that it allows for a geometric growth of capital because the size of your position grows in relation to the equity growth in your trading account. Adjust your position according to your backtest results and look for less volatile swings in your trading account.

Formula: Number_of_units = (Current_Capital * %_of_Capital ) / Initial Margin

The limitation of this method is that not all investments are the same and it doesn’t allow you to increase your exposure rapidly with a smaller trading account. Let’s say your strategy allows you to trade one unit of S&P 500 futures and one unit of RBOB Gasoline futures. The problem with this approach is that it ignores the daily range (volatility) of the specific market. Thus what will happen with your portfolio will depend on the contract with the higher volatility. Furthermore a smaller account will not be able to increase the position sizes rapidly. The purpose of an antimartingale strategy is to increase your exposure when you are on a winning streak. The units per fixed amount of money model doesn’t give you equal opportunity to exposure. One way to equalize the elements of your portfolio is to take the volatility for each contract into account.