10 Key Points in a Companies 10Q Report

10-Q Filings Tips and Tricks

A company’s 10 Q report is one of the most important tools an investor has to decide if and when a particular stock is a buy/short opportunity. The majority of investors is reading these reports yet most of them fail to properly understand the lingo used in these reports. What most investors miss or are not capable of doing is reading between the lines and interpreting the data correctly.

Federal securities laws dictate that publicly traded companies must provide certain information. A company is obligated to send in their Form 10-Q upon the completion of each quarter to disclose unaudited financial statements and give an overview of the company’s financial situation. The filing dates depend on the organization’s fiscal year.

Content of the 10 Q

- Income Statement, Balance Sheet, Cash Flows

- Management’s discussions and analysis of financial conditions and results

- Disclosures of market risks facing the company and notes about controls and legal proceedings

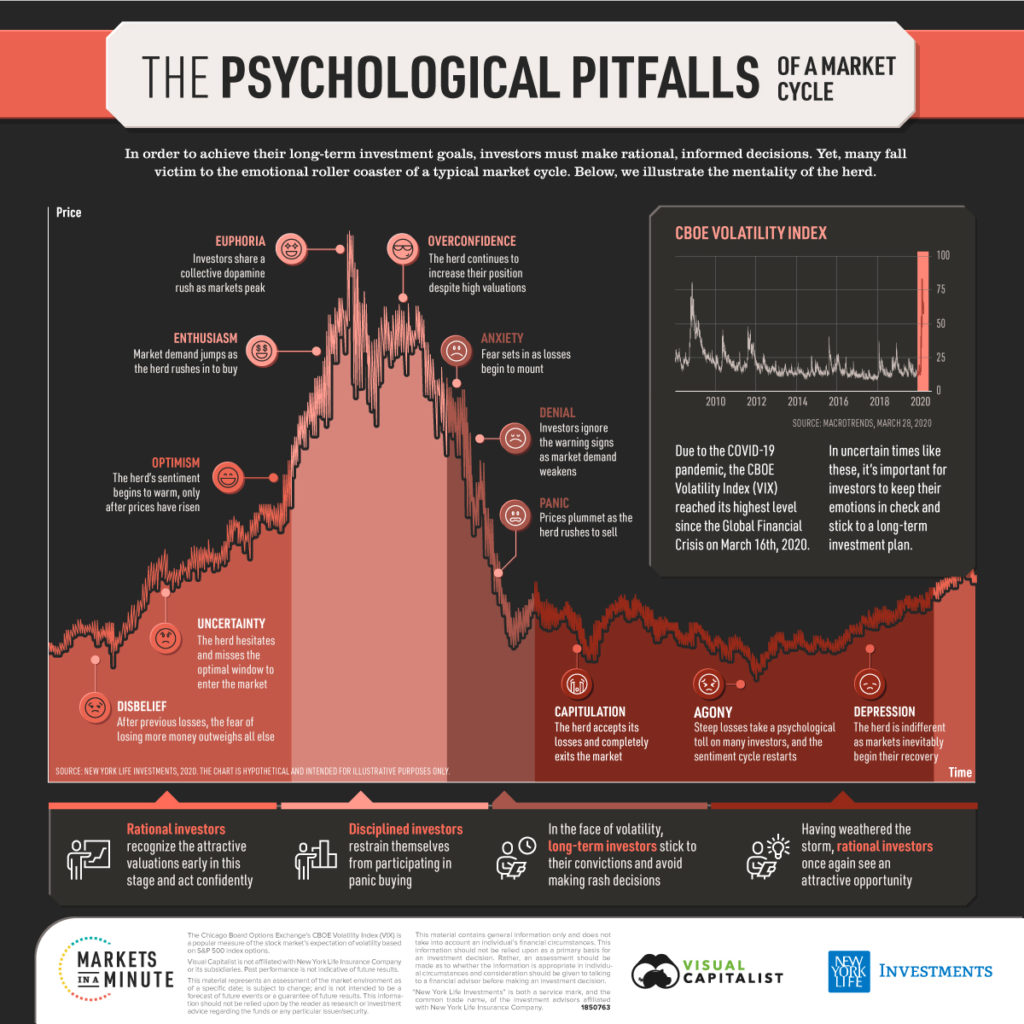

When analyzing the 10Q report it is important to already know what the debt guys are thinking about this stock. Typically a credit investor has to read everything, even supplementary filings. These filings can give you insights which most equity investors miss. Most of us know that the credit market recognizes things ahead it is a sort of looking forward indicator. Credit investors have their focus on cash flow and how it can support future debt r repayments. Most of the information regarding the company’s debt will be in the footnotes and investors should look for the term “structure and different components of debt” in order to filter out the important information. As a smart investor you should really devote your time in reading these footnotes because believe it or not at least 90% of investors are not doing this and therefore miss out on important bits of information. As rule of thumb the best approach is to pick a stock and observe the important trend changes in the stock price and then you analyze the filings/news trying to determine what kind of lingo and/or data made this stock go up/down in price. We cannot give you the exact terminology or numbers you should look out for since this is sector specific. Capital-intensive industries, such as oil and gas refining require significant financial resources and large amounts of money to produce goods or services so changes in debt or comments regarding the debt outlook will not have such a high impact on the stock price compared to other sectors which are less capital-intensive.

repayments. Most of the information regarding the company’s debt will be in the footnotes and investors should look for the term “structure and different components of debt” in order to filter out the important information. As a smart investor you should really devote your time in reading these footnotes because believe it or not at least 90% of investors are not doing this and therefore miss out on important bits of information. As rule of thumb the best approach is to pick a stock and observe the important trend changes in the stock price and then you analyze the filings/news trying to determine what kind of lingo and/or data made this stock go up/down in price. We cannot give you the exact terminology or numbers you should look out for since this is sector specific. Capital-intensive industries, such as oil and gas refining require significant financial resources and large amounts of money to produce goods or services so changes in debt or comments regarding the debt outlook will not have such a high impact on the stock price compared to other sectors which are less capital-intensive.

Let’s start with an example and have a look at Chesapeake Energy Corporation.

From the 10 Q report :

Since December 2015, Moody’s Investor Services, Inc. and Standard & Poor’s Rating Services have significantly lowered our credit ratings. Some of our counterparties have requested or required us to post collateral as financial assurance of our performance under certain contractual arrangements, such as gathering, processing, transportation and hedging agreements. As of August 1, 2016, we have received requests and posted approximately $274 million in collateral under such arrangements……………… We may be requested or required by other counterparties to post additional collateral in an aggregate amount of approximately $664 million…………….Any posting of additional collateral consisting of cash or letters of credit, which would reduce availability under our revolving credit facility, will negatively impact our liquidity.

We may seek to access the capital markets* or otherwise incur debt to refinance a portion of our outstanding indebtedness and improve our liquidity…..

Doesn’t sound encouraging and when we scroll down to the bottom of the 10 Q report we can read the following:

In April 2016, a class action lawsuit on behalf of holders of the Company’s 6.875% Senior Notes due 2020 (the 2020 Notes) and 6.125% Senior Notes due 2021 (the 2021 Notes) was filed in the U.S. District Court for the Southern District of New York relating to the Company’s December 2015 debt exchange, whereby the Company privately exchanged newly issued 8.00% Senior Secured Second Lien Notes due 2022 (Second Lien Notes) for certain outstanding senior unsecured notes and contingent convertible notes. The lawsuit alleges that the Company violated the Trust Indenture Act of 1939 and the implied covenant of good faith and fair dealing by benefiting themselves and a minority of note holders who are qualified institutional buyers (QIBs). According to the lawsuit, as a result of the Company’s private debt exchange in which only QIBs (and non-U.S. persons under Regulation S) were eligible to participate, the Company unjustly enriched itself at the expense of class members by reducing indebtedness and reducing the value of the 2020 Notes and the 2022 Notes………

The above excerpt is an example of a very important piece of information that can/will impact the stock price and as we mentioned before this kind of information is missed by most investors. Key point in this report -> Cash flow is insufficient to service the long-term debt…..*Further stock dilution to be expected.

After the financial statements one of the most read parts of the 10 Q are Management Discussion & Analysis.

Keywords to look out for

“anticipates” “could” “forecasts” “might” “projects” “believes”

“estimates” “intends” “plans” “scheduled” “budgets” “expects”

“may” “predicts” “should” “impact of” “cancellation” “criminal”

“access to liquidity” “contract backlog” “inadequate liquidity”

For example, here is part of Transocean’s summary of why net income fell in the second quarter of Transocean’s fiscal 2016, compared to the same quarter in 2015:

Drilling contract terminations and cancellations—As a result of recent market conditions, we have observed an unprecedented level of early drilling contract terminations and cancellations in the contract drilling industry. In the six months ended June 30, 2016, we recognized revenues of $218 million associated with early terminations and cancellations of drilling contracts for six of our rigs. See “—Outlook,” “—Operating Results” and “—Liquidity and Capital Resources—Sources and uses of cash.”

In other words, we cannot absorb low oil prices much longer.

Another important factor when reading this reports are the quarterly comparison tables. The significance of the most actual 10 Q report depends on what came before. Therefore most 10-Q’s offer comparisons to prior quarters, both in tables and in the text as a whole.

Legal Proceedings

Companies are required to tell investors about significant legal proceedings. This section of the 10-Q filings is typically titled “Legal proceedings”. Most of the time this section will only have a few lines which typically indicates there was no significant change since the last report. In those cases where we had new developments the company will disclose it and refer back to earlier reports for more detailed information. What’s most important is to be aware of the fact that companies are not obligated to report developments in a chronological order which means you need to look at sections of two filings next to one another and compare them. Sometimes companies tend to change the phrasing or add a few words.

How to search for Key-phrases

There are a lot of options here one of the sites we use for keyword searches in sec filings are Edgar Pro. We have performed a search for you using the key-phrase “going concern” and we have focused our search results to the energy sector. Here are a few search results: Dala Petroleum Corp., Lucas Energy, Empire Petroleum, Renovacare, Geospatial, ERHC Energy, Torchlight Energy Resources, Enerjex Resources, Pacific Oil, Alpha Energy, Barnwell Industries, Vertex Energy, Transatlantic Petroleum, Swift Energy;

We have chosen to search for the key-phrase “going concern” and yes this was not random. One thing that should make you worry about a company’s future is the “going concern” clause. The clause is one of the strongest warnings that a company’s auditor can issue and signals a high probability of company liquidation. In the 10 Q filing you will read something like this “factors….. create substantial doubt as to the Company’s ability to continue as a going concern.” This should ring the alarm bells. Another important section is titled “Subsequent Events” and discloses developments of significance that occurred a few weeks between the end of the quarter and the 10 Q filing.

Very Beneficial content!!!! Many thanks for sharing these practical information with us! This particular post is among the finest articles I came across up to now.