Wealth Hub – Discord Community

Where Traders Unite for Sucess

Welcome to a world where financial insights meet market mastery. Wealth Hub is your exclusive gateway to a suite of premium features designed to empower traders and investors like you.

Whether you’re a seasoned professional or just starting, our platform offers a unique blend of real-time updates, expert analysis, curated trade ideas, copy trades and a thriving community to help you navigate the markets with confidence.

As seen on

Collaborate and Prosper

Join the Wealth Hub Discord channel – the premier platform for market enthusiasts. Equip yourself with cutting-edge market analyses, personalized research, and unparalleled bot features designed for seasoned investors. Stay ahead of the game with real-time market updates, enrich your portfolio by sharing insights and ideas with with the community.

✔️ Cutting edge discord bot for advanced analysis

✔️ Educational material – videos, podcasts and tools

✔️ High signal investment research

✔️ Copy trade portfolios

Copy Trading

25% annualized gain*

Backtest results In-Sample & Out-of-Sample +3700% since 2005

Features that Set Us Apart:

✔️ Quarterly Updates: Stay ahead of the curve with updated portfolios.

✔️Easy-to-Follow Strategy: Adjustments once every quarter, making the strategy simple to follow.

✔️ Hold for Success: Some positions are strategically held for several quarters, enhancing long-term performance.

✔️ Diverse Portfolios: Portfolios with up to 15 stocks

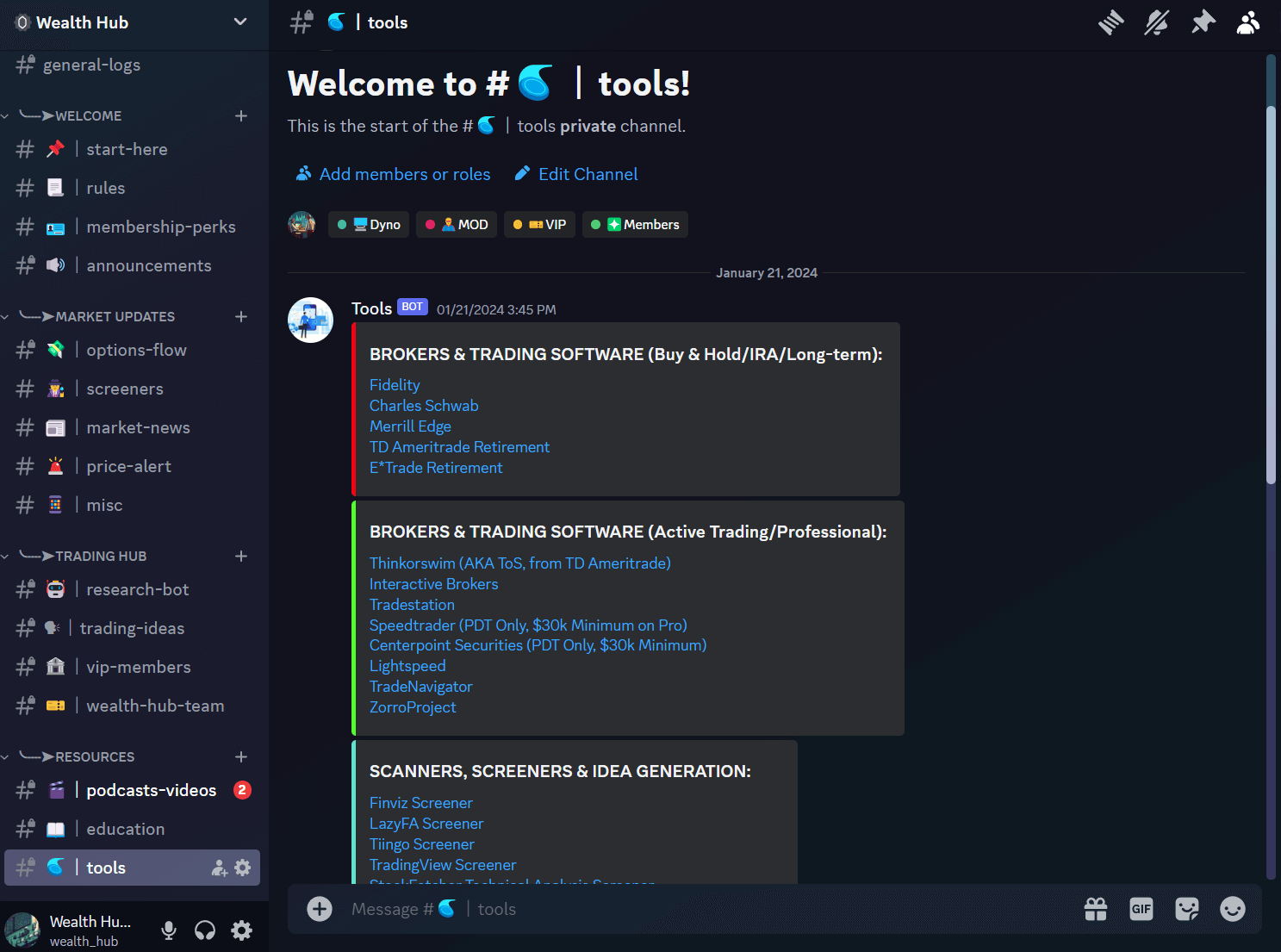

Discord Community

Why Choose Wealth Hub?

✔️ Real-Time Market Updates: Stay ahead of the curve with instant updates on market trends and breaking news.

✔️ Curated Trade Ideas: Access handpicked trade ideas from seasoned experts to guide your investment decisions.

✔️ Interactive Community: Join a community of like-minded traders, share your perspectives, and engage in fruitful discussions.

✔️ Expert Analysis: Benefit from expert analysis that goes beyond the headlines, providing you with nuanced insights into market movements.

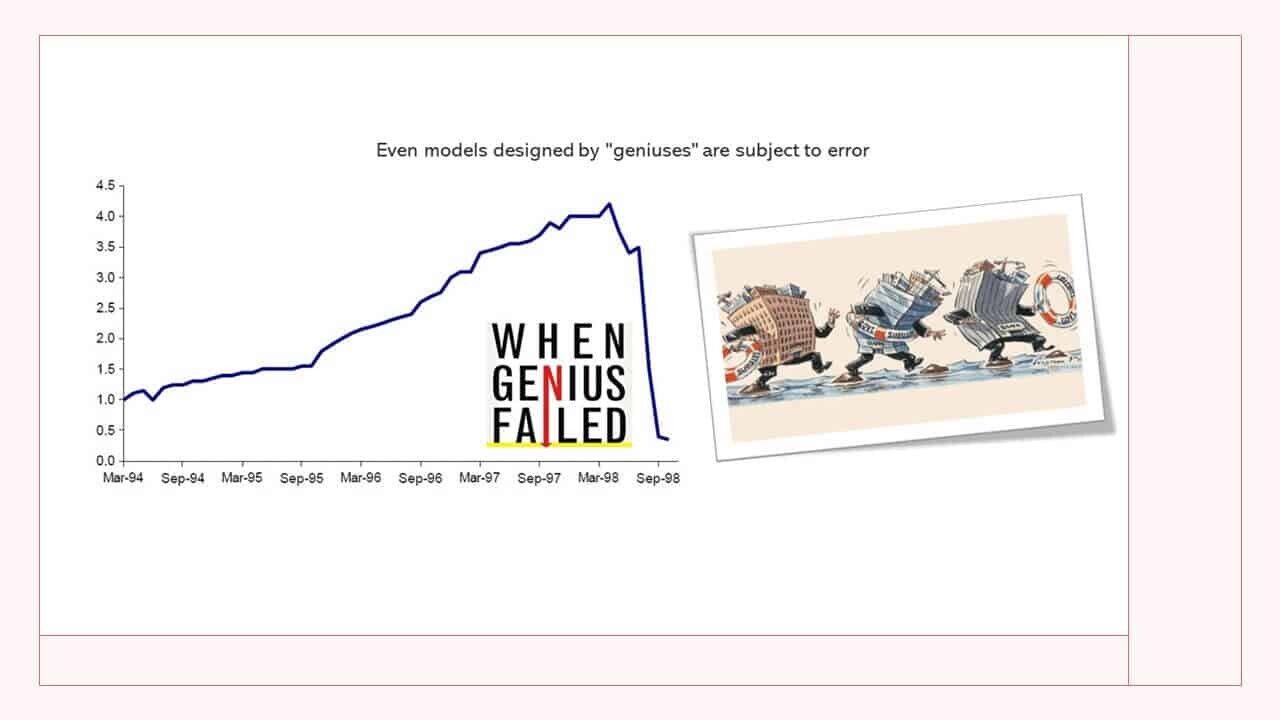

*Disclaimer: Past results are not indicative of future performance. This information does not constitute investment advice. Always conduct thorough research and consider individual circumstances before making financial decisions. The statement regarding a 25% annual return since 2005, as derived from both in-sample and out-of-sample backtests, is based on historical simulations and performance assessments conducted through our trading platform and backtesting engine.

Your Gateway to Collaborative Trading Excellence

🌐Comprehensive Market Updates

Stay informed about market trends, breaking news, and critical insights tailored to your preferences. With dedicated channels, you can effortlessly browse and delve into the information that matters most to you.

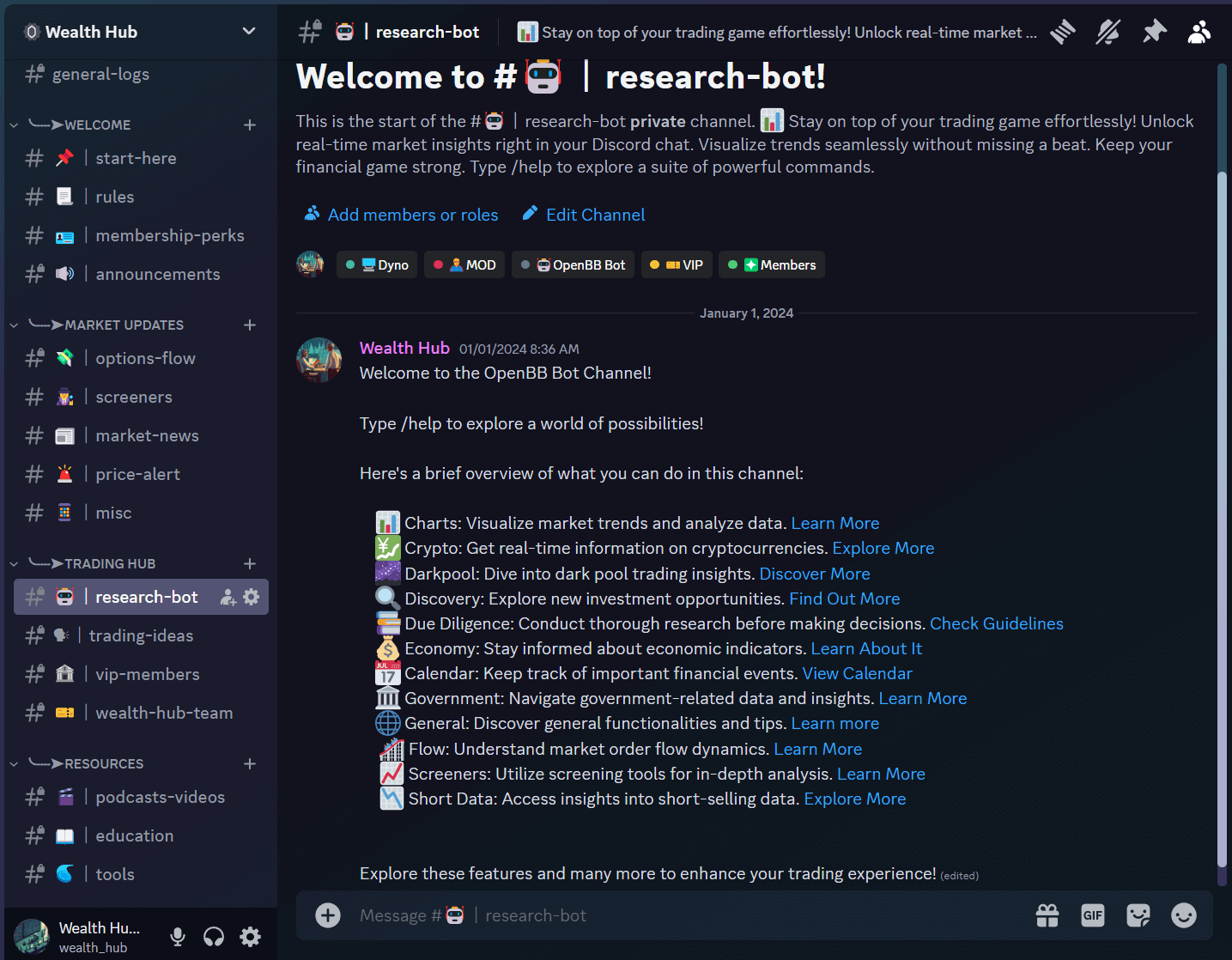

🥏Dynamic Trading Hub

Our Trading Hub category is a powerhouse of knowledge, to cater to your diverse trading needs. The research-bot channel enables subscribers to conduct independent research using OpenBB.

📘Rich Resources for Learning

Explore our Resources category, where valuable content awaits. The podcast channel regularly uploads insightful videos, and the education channel is continually populated with useful information.

🪪Wealth Hub Member Benefits

As a valued subscriber, you’re embarking on a journey filled with real-time market updates, curated trade ideas, and instant portfolio insights. Engage with an interactive community, benefit from expert analysis, and make informed decisions.

🔍VIP Members Channel

Subscribers to the Professional plan gain access to the VIP-members channel. This exclusive space allows professionals to connect, share insights, and collaborate. Stay ahead of the curve by engaging with like-minded professionals.

💻Charts, Crypto, Darkpool and more

Navigate through the OpenBB Bot Channel, where a plethora of possibilities await. From visualizing market trends with charts to exploring dark pool trading insights, this channel is your go-to hub for in-depth analysis and much more.

Unlock Your Financial Success: Select Your Wealth Hub Plan Now!

Coming soon….

Don’t save your questions. We’ve got answers.

The Wealth Hub really is as good as it sounds, but if you’re a doubter these FAQs may help.

How can I stay updated on real-time market trends and breaking news in the Wealth Hub Discord community?

You can stay updated on real-time market trends and breaking news by joining the “Market Updates” category, which provides automatic market updates across various channels.

What resources are available in the Wealth Hub Discord community’s “Resources Category”?

In the “Resources Category,” you’ll find the “podcast” channel, which regularly uploads valuable videos related to trading and investing.

Are there any additional fees or hidden charges apart from the subscription cost?

No, there are no hidden fees. The subscription cost is all-inclusive, covering portfolio management, quarterly updates, and access to all plan features. We believe in transparent pricing to ensure a straightforward and fair experience for our subscribers.

Where can I find curated trade ideas from seasoned experts in the Wealth Hub Discord community?

You can discover meticulously curated trade ideas by exploring the “Trading Hub Category,” specifically the “trading-ideas” channel, where members exchange trading ideas.

How can I connect with other like-minded members and engage in insightful discussions in the Wealth Hub Discord community?

You can immerse yourself in a dynamic exchange of ideas by joining the “Interactive Community” and participating in discussions across various channels dedicated to trading and investing.

How does the ad-hoc update feature work?

The ad-hoc update feature notifies subscribers promptly when our AI identifies unique market opportunities. Whether it’s a situational trade or a strategic move, you’ll receive real-time updates to help you make informed decisions and capitalize on market dynamics.

How can I access expert analysis and profound commentary on market movements within the Wealth Hub Discord community?

To access expert analysis and profound commentary, visit the “Trading Hub Category” and engage with the “research-bot” channel, where you can conduct your own research using openBB.

What benefits do Professional Plan subscribers enjoy in the Wealth Hub Discord community?

Professional Plan subscribers gain exclusive access to the “vip-members” channel within the “Trading Hub Category,” providing additional resources and opportunities for trading insights, allowing them to potentially replicate successful trading strategies.

Can I make changes to my subscription?

Certainly! You have the flexibility to modify your subscription and update your details conveniently through the customer portal. Find the link above to access the portal and manage your subscription.

Disclaimer: The information provided on this page is for informational purposes only and should not be considered as financial advice. Investing involves risks, and past performance is not indicative of future results. It is crucial to conduct thorough research and, if necessary, consult with a qualified financial professional before making any investment decisions. The content on this page does not guarantee any specific outcomes, and the user is solely responsible for their investment choices. The content on this page does not guarantee specific results or account for individual circumstances. Each investor’s financial situation is unique, and considerations such as risk tolerance, financial goals, and market conditions should be carefully evaluated.