FAQ Wealth Hub Archive

GENERAL

Frequently Asked Questions

Wealth Hub Archive – Your Trading Knowledge Base

What is the Wealth Hub Archive?

The Wealth Hub Archive is a curated digital collection of 42 past magazine issues (published between 2020 and 2024) that cover a wide range of trading strategies, market research, and quant investing ideas. It is available via a one-time payment and offers lifelong access to all current issues. While the core archive is static, we may occasionally release updates or bonus material. Most content is evergreen and remains relevant over time.

How many magazines do I get?

You get full access to 38 PDF issues, totaling over 500 pages of in-depth trading insights, strategy backtests, and tutorials.

Is this a recurring subscription?

No, this is a one-time payment. You get permanent access to the full archive. No future issues will be released regularly, though updates may be added occasionally.

What topics are covered in the magazine?

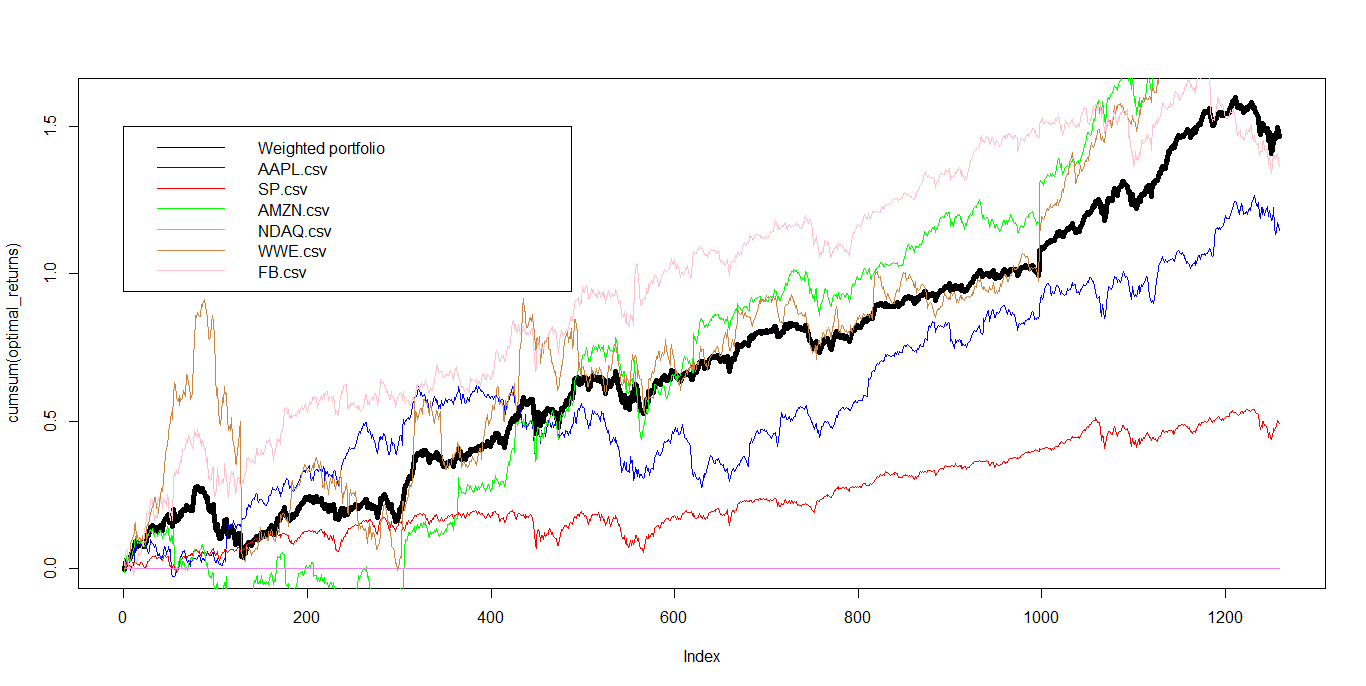

Each issue includes research on: Long-term investing models Mid-term swing strategies Short-term and intraday trading Quantitative trading Momentum, volatility, mean reversion, seasonality, and sentiment analysis

Which coding languages are used in the backtests?

We use Python, R, and EasyLanguage. These are selected based on strategy complexity, asset class, and platform suitability.

Is this publication worth the money?

Absolutely. For the cost of a book or two, you get years of curated, research-backed content, fully tested strategies, and practical examples across multiple styles of investing and trading.

Can I write for Wealth Hub Capital?

Yes. We welcome article submissions and proposals. Visit our Contribute page for more information on payments, editorial guidelines, and how to get started.

Do you offer support if I have questions?

Yes. Support is available via email. You’ll receive the contact details upon signing up.

Strategies & Trading Content

What time frames are covered in the strategies?

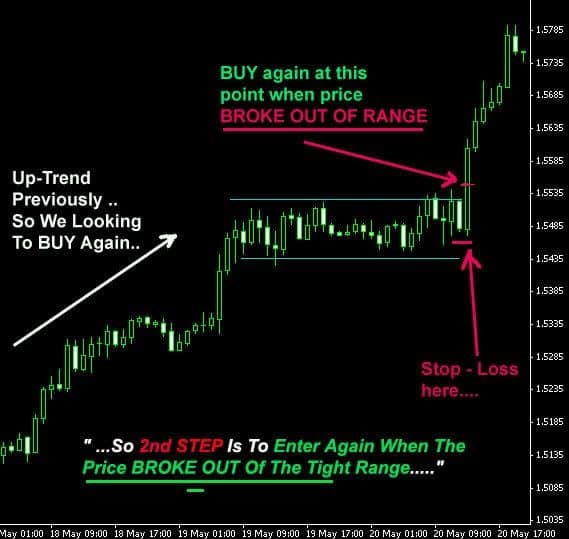

Long-term: Asset allocation, trend-following, annual/quarterly rebalancing models Mid-term: Swing strategies lasting several days to weeks Short-term: Intraday and automated trading models

What types of strategies are included?

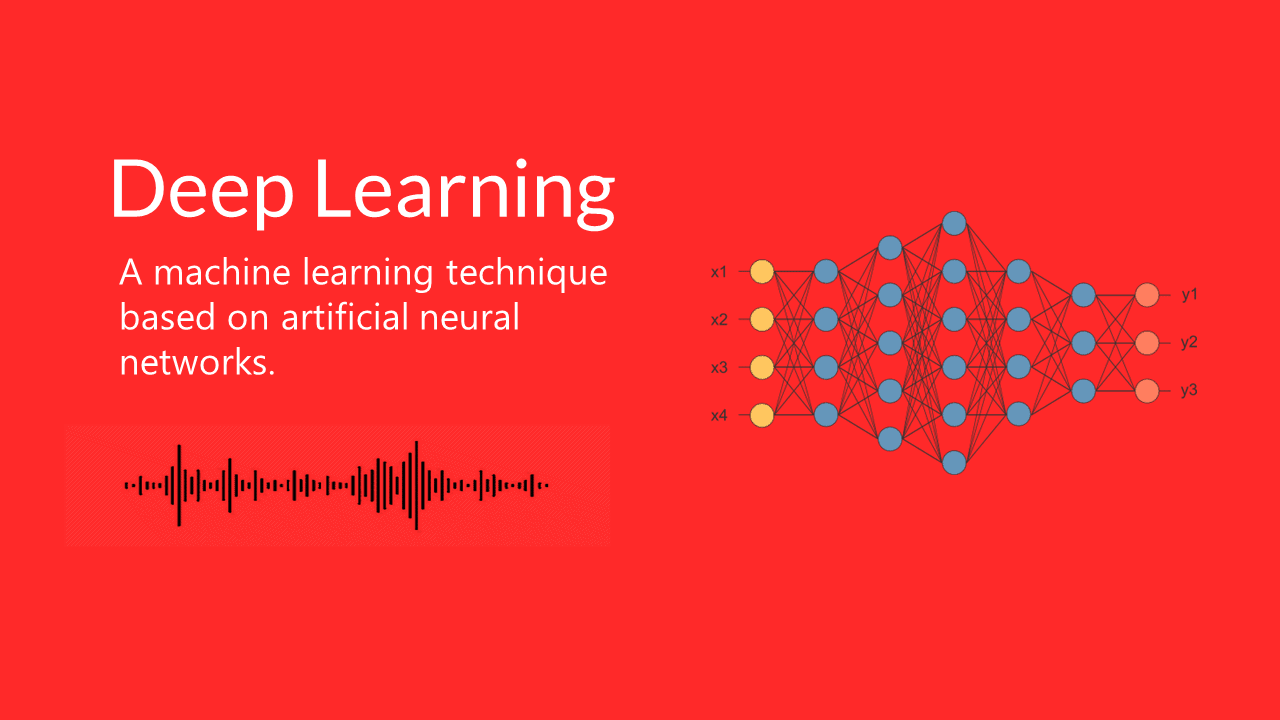

Seasonality-based strategies Momentum & volume analysis Volatility-based models Spread and pairs trading Sentiment and machine learning Trend-following and mean reversion

Do you offer code for QuantConnect or other platforms?

We provide code samples in Python, R, and EasyLanguage. Some strategies may be portable to platforms like QuantConnect, but native support is not guaranteed.

Is this archive suitable for beginners?

Yes — while some content assumes familiarity with trading or coding, many articles include introductory explanations, making the archive suitable for ambitious beginners and experienced quants alike.

Account & Payments

How do I access the archive?

Once payment is complete, you’ll receive instant access to download all magazine issues in PDF format.

What forms of payment do you accept?

We accept major credit and debit cards (Visa, Mastercard, AmEx, etc.) securely via Stripe.

How do I know when my subscription ends?

There is no recurring subscription. You own lifetime access to the archive upon purchase.

How can I get additional support?

You can contact us directly using the support email provided in your welcome message or via the contact form on our site.