Weekly Market Report

Market Sentiment

Support and Resistance

December 16 Thirty Year Treasury Bonds

Support 152^00 Resistance 153^30

December 16 Gold

Support 1202.0 Resistance 1221.0

December 16 Copper

Support 2.4590 Resistance 2.5450

December 16 Silver

Support 15.60 Resistance 19.60

January 17 Crude Oil

Support 46.31 Resistance 48.98

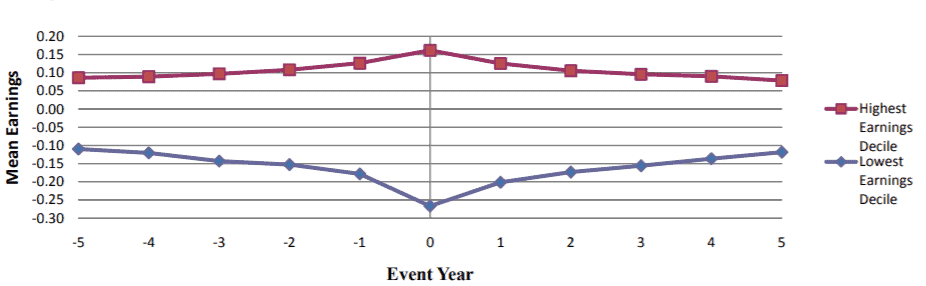

10 year Pattern Analysis

E-mini S&P 500 – Enter Long: Trading Day 10 of Month:Dec. , Exit Long: Trading Day 17 Month: Dec. >> Stats: Win% 80

Swiss Franc – Enter Long: Trading Day 15 of Month:Dec. , Exit Long: Trading Day 19 Month: Dec. >> Stats: Win% 70, increased volatility

Japanese Yen – Enter Long: Trading Day 07 of Month:Dec. , Exit Long: Trading Day 08 Month: Dec. >> Stats: Win% 70

Crude Oil – Enter Long: Trading Day 17 of Month:Dec. , Exit Long: Trading Day 18 Month: Dec. >> Stats: Win% 70

Commentary

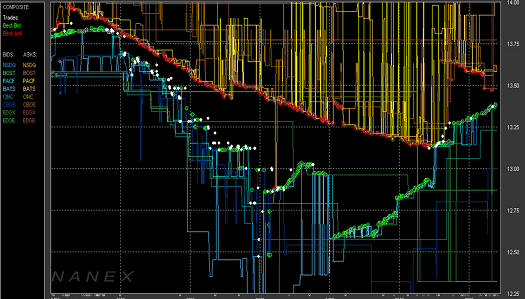

Swiss National Bank governing board member Andréa Maechler, speaking in Geneva, said the country’s currency remains stubbornly overvalued despite efforts to bring it down. SNB prepared for additional market intervention. Highest Volatility and possible time of interventions

“Alongside the negative interest rate, our willingness to intervene in the foreign-exchange market as necessary constitutes a key element of our current monetary policy,” SNB governing board member Andréa Maechler said in prepared remarks to a conference in Geneva.

“Nonetheless, the Swiss franc remains significantly overvalued,” she said.

Long term support level currently at 0.9880

The use of unconventional measures poses some challenges for the implementation of monetary policy. For the Swiss National Bank, whose monetary policy is based on a negative interest rate and foreign currency purchases, it was necessary to deepen its understanding of the market, refine its analytical tools and strengthen its market contacts.

If central banks exert a greater influence on financial market prices than previously, this could result in these prices becoming disconnected from the real economic environment, and only reacting to monetary policy. In fact, we observe that some traditional relationships and correlation patterns on the financial markets have changed in recent years. However, in addition to unconventional monetary policy measures, this is also due to the globalization of financial markets and parallel economic and price developments. Moreover, the phenomenon of interpreting bad news from the economy as good news for the markets already existed before the financial crisis, especially on the equity markets. The question of just how much the greater activity of central banks on the financial markets has changed the traditional price relationships and correlation patterns is difficult to answer definitively. Ultimately, financial market prices continue to reflect investor expectations for the future development of the economy and inflation. – Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

A huge selloff on the global bond market has also seen money flow into the greenback, putting further pressure on other currencies. National Australia Bank foreign exchange strategists have forecast the Aussie dollar to drop towards US70c during 2017, and even lower in 2018.

The markets driven by Trump may be just about to have run their course for now. A rise in interest rates is, generally speaking, not good thing for stocks, especially for emerging markets. But if you think that US bond yields, which have been falling since 1982, may be bottoming out, that could mean the end of a low-growth/ low-inflation regime. – Toru Ohara, chief investment officer at Okasan Asset Management

The U.S. dollar is lower after Fischer of the Federal Reserve today said strength in the U.S. dollar will have a negative impact on exports. Longer term, however, the greenback will be underpinned by prospects of a fed funds rate increase at the Fed’s December meeting. Expect the U.S. dollar to remain firm in advance of the December 13-14 FOMC policy meeting.

Fortunately, the market consensus concerning the dollar’s continuing rise as US interest rates increase is almost certainly wrong, for three reasons.

- First, the divergence of monetary policies between the US and other major economies is already universally understood. Thus, the interest-rate differential, increase of US interest rate is already priced into currency values.

- The widely assumed correlation between monetary policy and currency values does not stand up to empirical examination. In some cases, currencies move in the same direction as monetary policy – for example, when the yen dropped in response to the Bank of Japan’s 2013 quantitative easing.

- Finally, monetary policy is not the only determinant of exchange rates. Trade deficits and surpluses also matter, as do stock-market and property valuations, the cyclical outlook for corporate profits, and positive or negative surprises for economic growth and inflation.