Market News – March 31 2016

Economic Events

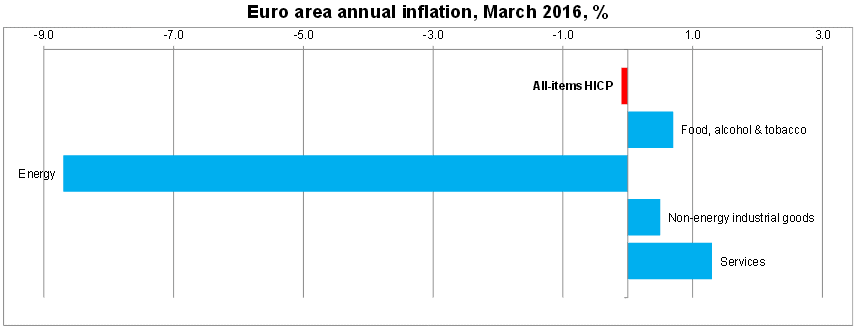

The Unemployment Rate released by the Bundesagentur für Arbeit shows 6.2 % vs. 6.2 % expectations. Housing starts in Japan show an increase of a whopping 7.8% vs. -2.4 % expectations. Generally speaking, a high reading is seen as positive, or bullish for the JPY. The core CPI in Europe came in at 1%. Euro area annual inflation is expected to be -0.1 % in March 2016, up from -0.2 % in February according to a flash estimate from Eurostat. Looking at the main components of Euro area inflation services is expected to have the highest annual rate in March 1.3 % vs 0.9 % in February.

U.S Treasury announced a $52 B 3- and 6-month bill auction for Monday, that’s down another $5 B from this week’s volume, which itself was a cut of $5 B from the prior week. The 3-month tranche was reduced by $3 B to $28 B, while the 6-month was trimmed by $2 B to $24 B. Chicago PMI pop to 53.6 in March from 47.6 in February that joined the sharp sentiment upturn in other available March reports. Initial claims rise to 276k in the final week of March that left a 23k three-week climb from a 253k cycle-low at the start of the month. Fed’s Evans echoed Yellen’s comment that continued caution is warranted on the policy path, due to low inflation (the FOMC non-voter is speaking on Bloomberg Radio). He’s projecting one hike at mid-year and one at year-end.

Energy Action

NYMEX crude got a boost from the firmer Chicago PMI data, while continued dollar weakness has been supportive as well. The contract intra day high was $38.84, up $1/bbl from earlier lows of $37.84. Before close we had a sharp decline to $38.34, signaling further downside potential. Gas Inventories 25 Bcf vs. consensus of 25 Bcf draw.

Fed Policy Outlook

FOMC is still on course to increase rates this year according to comments from a number of Fed officials. Analysts continue to forecast 25 bp increases in June and December. Yellen’s dovish speech on Tuesday imparts non-negligible risk to that outlook. She outlined a number of uncertainties to the outlook (indeed she even injected “Uncertainty” into the title of the speech at the last-minute), including still slow growth, especially noting China and the potential bearish spillover across the Asian regions, ongoing low inflation with the possibility that the recent uptick in core prices may not prove durable. The June 14, 15 FOMC will come just one week ahead of the UK Brexit vote, and there may be too much volatility around that for the Fed to act.

FX Market

The dollar rallied marginally after the better Chicago PMI outcome, though the effort was quickly sold into. EUR-USD dipped to 1.2380 from 1.1390, and has since hit fresh highs of 1.1406. USD-JPY ticked up to 112.28 from 112.15, and has since settled into the 112.50 region.

Stock News

- Medivation (MDVN) has been a takeover target, as its stock is down 31% from highs last year even after a 23% rise on merger speculation. Medivation doesn’t seem interested in selling, and analysts estimate a fair acquisition value could be anywhere from $50 per share to $70 per share.

- The SEC announced it has charged Navistar with “misleading investors” about its development of an advanced technology truck engine that could be certified to meet U.S. emission standards. Navistar, without admitting or denying the charges, has reached a settlement with the SEC and agreed to pay a $7.5M penalty.

- Shares of Valeant Pharmaceuticals hit new 52-week low after dropping over 4% to $25.87. The stock’s selloff continues after the Wall Street Journal reported last night that Pershing Square’s Bill Ackman, called lenders in the hopes of getting an additional cushion for Valeant’s debt terms.

- Fitbit’s (FIT) shares are surging after research firm Longbow initiated coverage of the stock today with a Buy rating. The company announced today that it had shipped more than 1M units of its new Blaze fitness tracker in the first month in which it was made available. Fitbit’s products are off to a great start this year. Retailers bought more of the company’s products this month, implying that its first quarter results will beat expectations. Up +13 % in todays trading session.