Most Important Economic Indicators

What are the most important Economic Indicators and what do they mean ?

This post will be a series of several articles describing the most important economic indicators and how you can use them in your day-to-day trading ventures. The following questions will be answered :

- Why is the particular indicator important ?

- What does the indicator tells us about the market ?

- How are certain assets affected by the indicator ?

- How is it computed ?

We are living in a globalized world were its important to analyze the indicators as a whole and interpret the data. However, one important caveat to keep in mind is that no country collects as much economic high quality data like the U.S. It can be seen as the world standard. The purpose of this article is to give you a better understanding at how to look at the economic data that is released. Yet alone the U.S. releases about 60 economic indicators every week, month and quarter. This is the reason why the markets are in perpetual motion. Large investment banks are paying huge amounts of money to certain sources who are willing to leak economic news to the firm’s traders before writing about it. As a matter of fact trading based on inside information is rather the norm than the exception. This is one more reason to avoid using economic indicators for short-term trading.

The following list shows you the economic indicators that track the health of the U.S. Economy :

Real GDP and its Components ( consumption , goods, services) – Key Indicators :

- Chain store sales

- Real earnings

- Auto sales

- Retail sales

- Personal Income and Spending

- Consumer installment credit

- New claims for unemployment insurance

- Employment report

- Sentiment Surveys

- MBA mortgage refinancing

Gross Private Domestic Investment – Business Spending :

- Factory orders

- ISM surveys – ISM PMI/ISM NMI

- Manufacturers shipments

- Federal Reserve Bank regional surveys

- Industrial Production

- Capacity Utilization

Residential Key Indicators:

- MBA mortgage applications

- Housing starts

- New family home sales

- Existing home sales

- NAHB survey on home building

- Case Schiller Home Price Indices

Business inventories and government spending:

- Manufacturing and trade inventories

- Federal budget balance report

- Construction spending

Net Exports:

- Current account balance

- International trade

Inflation measures Key Indicators:

- Unit labor cost

- Import and export prices

- Employment cost index

- Producer price index

- Consumer price index

- Federal Reserve Beige Book

- Non farm productivity

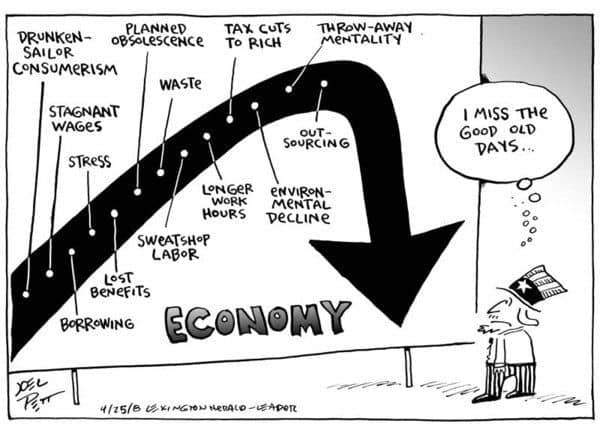

The important concept and at the same time the most difficult to grasp is to gain the ability to see the links between all those indicators when generating your world view. Different indicators can give you opposite signals that’s why its important to filter those out that actually move the markets and give us an in-depth look on the economic situation. The important measures on determining the importance of an economic indicator is accuracy,timeliness and the business cycle. The first two can be found by visiting the actual website where the economic indicator of interest is released. The stage of the business cycle is something you learn by observing the markets. How do you mean observing ? Go through the different business cycles and see for yourself. For example the consumer price index, which gauges inflation at retail level impacts the markets depending on the stage of the business cycle. During a recessionary period indicators that move the markets are housing starts or the UMCSI which often provide clues that an economic recovery is possible. When the business activity is trending up measures like the CPI become more important while the other ones move into the background.

Those who want to know what is ahead for the economy should focus their energy on analyzing the unemployment claims, ISM PMI/NMI and the building permits. Of course it also depends on which assets you are currently having in your portfolio. We will outline which of the indicators influence what kind of assets.

Indicators most sensitive to Bonds

- GDP

- Housing Starts

- Industrial production and capacity utilization

- Employment Situation Report

- ISM PMI

- Retail Sales

- Consumer Prices

- Producer Prices

- Weekly claims for unemployment insurance

- Personal income and spending

Indicators most sensitive to U.S. Dollar

- Retail Sales

- GDP

- Employment Situation Report

- International Trade

- Industrial Production and Capacity Utilization

- ISM PMI

- UMCSI

- Interest rate decisions from the major central bank

- Current Account

Indicators most sensitive to Stocks

- GDP

- ISM PMI and ISM NMI

- Employment Situation Report

- Consumer Prices

- Retail Sales

- Producer Prices

- Weekly Claims for Unemployment Insurance

- Personal income and spending

- UMCSI

- Durable Goods

Indicators that lead the rest of the economy are the ISM PMI, Housing Permits, Employment Situation Report, Producer Prices, Yield Curve and New Orders for Durable Goods. Important to note is the New Orders index of the ISM PMI which is a leading indicator for the ISM PMI itself. However, the economic performance of other countries must also be monitored in order to get the full picture of the U.S. Economy. U.S. companies are more and more dependent on foreign economic activity. About half the earnings of S&P500 companies come from business generated outside the United States. One of three factory jobs is export related. Foreign investors are lending the U.S. over $2 billion/day. This money flows into the capital markets. Foreigners own more than 50% of all U.S. treasury issues and about 30% of american corporate bonds.

So what are the most important international economic indicators ? Just look at the largest economies which are China, Germany, Japan, India and Brazil.

Most Important International Economic Indicators: China Industrial Production, German Industrial Production, German Consumer Price Index, Eurozone Purchasing Managers Report Manufacturing Index, Japan Industrial Production and Tankan Survey, Brazil and Indian Industrial Production.